Soluzioni Fintech

Sviluppiamo soluzioni di intelligenza artificiale su misura per il settore finanziario svizzero, con una profonda conoscenza delle sfide di sicurezza e conformità normativa (es. FINMA). Aiutiamo banche, assicurazioni e gestori patrimoniali a innovare, ottimizzare i processi e offrire servizi all'avanguardia.

Sfide Comuni

- Garantire la massima sicurezza dei dati sensibili

- Rispettare le complesse normative del settore

- Integrare nuove tecnologie con sistemi legacy

- Combattere frodi sempre più sofisticate

Le Nostre Soluzioni

Rilevamento Frodi in Tempo Reale

Implementiamo modelli di machine learning per analizzare le transazioni e identificare attività sospette con altissima precisione.

Automazione KYC e AML

Utilizziamo l'IA per automatizzare i processi di 'Know Your Customer' e antiriciclaggio, riducendo i costi e i rischi.

Consulenza Finanziaria Aumentata

Creiamo strumenti che forniscono ai consulenti insight basati sui dati per offrire consigli di investimento più personalizzati ed efficaci.

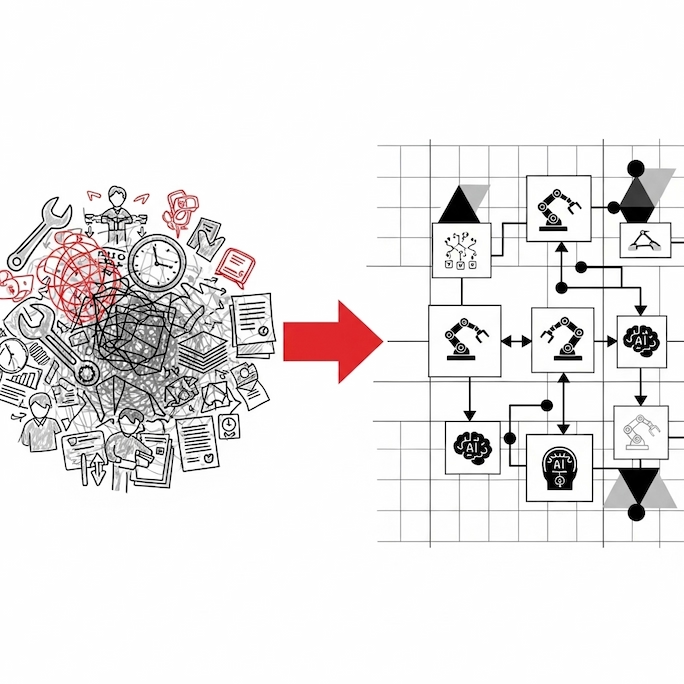

Il Nostro Approccio

Analisi di Conformità

Partiamo da un'analisi approfondita dei requisiti normativi (FINMA, LPD) per garantire che la soluzione sia pienamente conforme.

Progettazione Secure

Progettiamo l'architettura con un approccio 'security-by-design', integrando i più alti standard di protezione dei dati.

Sviluppo e Integrazione

Sviluppiamo la soluzione e la integriamo con i sistemi core-banking e le infrastrutture esistenti in modo sicuro.

Test di Sicurezza

Eseguiamo rigorosi test di sicurezza, inclusi penetration test, per validare la robustezza della soluzione.

Audit e Documentazione

Forniamo tutta la documentazione necessaria per supportare gli audit interni ed esterni.

Tecnologie e Strumenti

Caso di Successo

Caso di Successo: Sistema Anti-Frode per un Neobank

Abbiamo implementato un sistema di rilevamento frodi basato su IA per un neobank svizzero. Il sistema analizza le transazioni in tempo reale e ha permesso di ridurre le perdite per frode del 70%, migliorando al contempo l'esperienza dei clienti legittimi grazie a un minor numero di falsi positivi.

-70%

Perdite per frode

-90%

Falsi positivi

<100ms

Analisi per transazione

A Chi Si Rivolge Questo Servizio?

Banche e Istituti Finanziari

Che cercano di modernizzare i loro sistemi, automatizzare la conformità e offrire servizi digitali innovativi.

Compagnie di Assicurazione

Che vogliono ottimizzare la gestione dei sinistri, personalizzare le polizze e migliorare la valutazione del rischio.

Gestori Patrimoniali e Family Office

Che necessitano di strumenti avanzati per l'analisi di portafoglio e la consulenza ai clienti.

Servizi Correlati

Interessato al servizio Soluzioni Fintech?

Contattaci per una consulenza gratuita e scopri come possiamo personalizzare questo servizio per le esigenze specifiche della tua azienda.